Using synthetic intelligence (AI) in finance makes it attainable for monetary establishments to implement rising applied sciences like machine studying to streamline, automate, and enhance operations. Within the monetary sector, AI can facilitate high-frequency, predictive buying and selling, handle threat with refined credit score scoring, detect fraud, analyze markets, and personalize banking companies. Right here’s what you must know.

KEY TAKEAWAYS

- AI in finance is used to resolve a number of issues to assist improve productiveness and enhance the accuracy of economic transactions. (Bounce to Part)

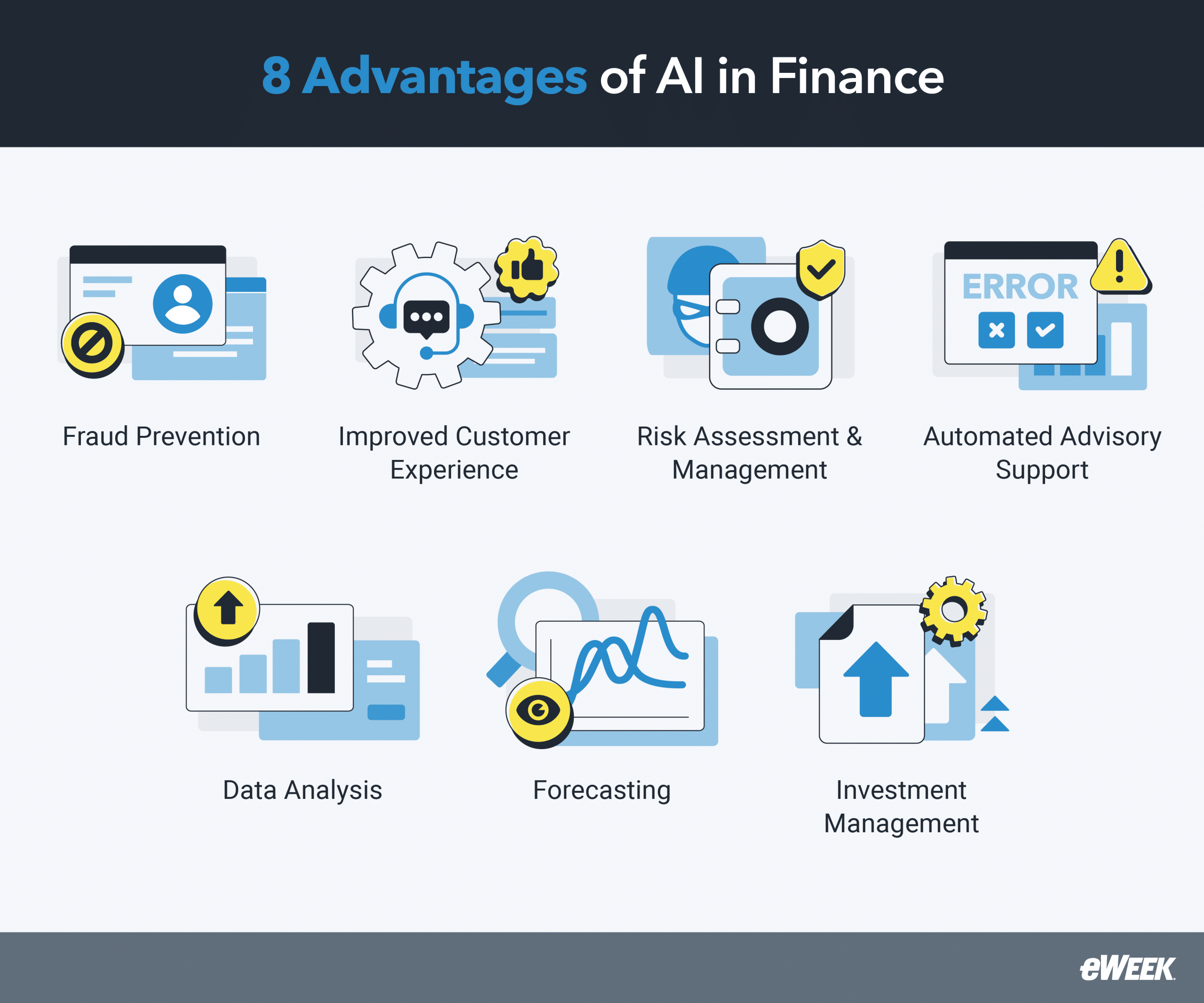

- Study extra about some great benefits of AI inside the monetary trade, corresponding to enhancing fraud prevention strategies, funding administration, and market forecasting. (Bounce to Part)

- Perceive the 4 foremost challenges of AI in finance the place knowledge privateness and regulatory issues, bias in algorithms, knowledge high quality points, and authorized necessities are issues that enterprise homeowners want to pay attention to. (Bounce to Part)

TABLE OF CONTENTS

Toggle

- KEY TAKEAWAYS

- How is AI Utilized in Finance?

- 3 Challenges of AI in Finance

- 3 Key Firms Utilizing AI in Finance

- 3 AI in Finance Programs to Take into account

- Backside Line: The Way forward for AI in Finance

How is AI Utilized in Finance?

AI can be utilized in monetary industries to resolve a variety of real-world challenges, from detecting anomalies and analyzing monetary traits and patterns to forecasting future monetary outcomes. AI and its associated applied sciences improve productiveness and enhance the accuracy and reliability of economic transactions. Right here’s a take a look at among the commonest makes use of of AI in finance:

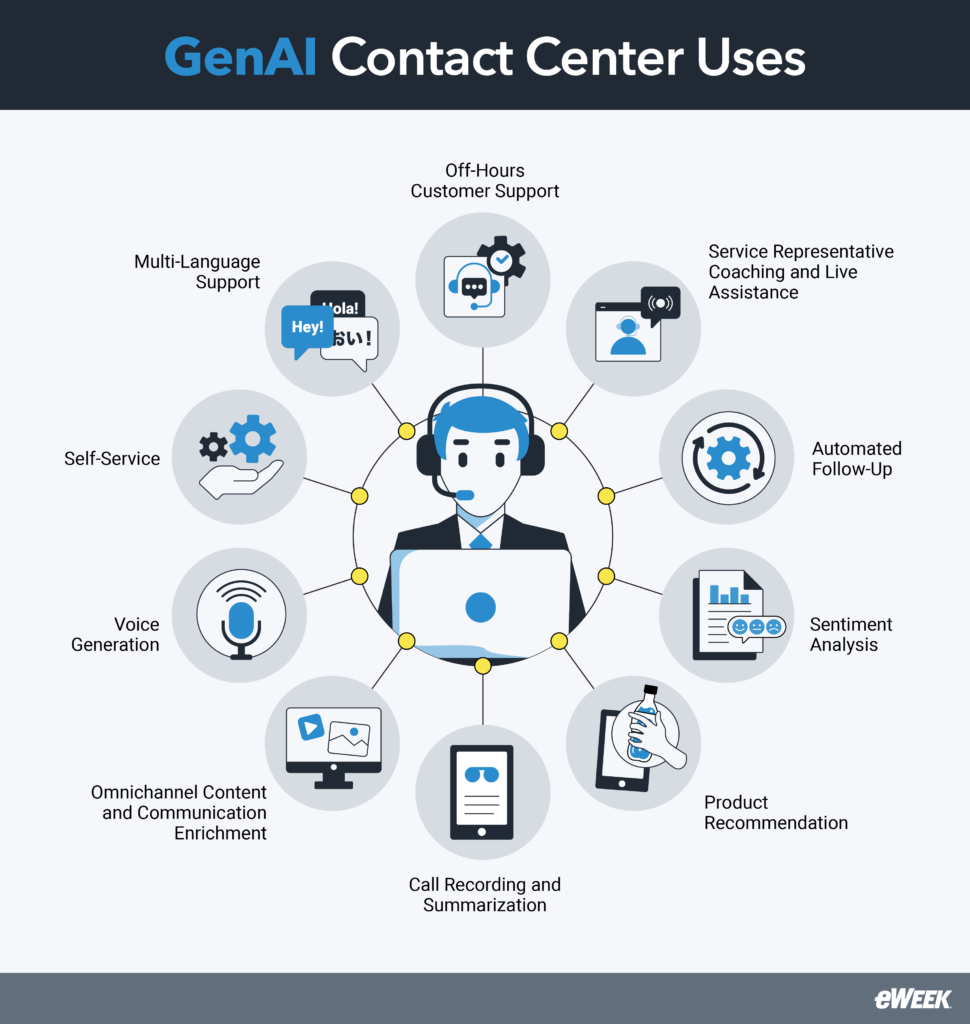

- Buyer Engagement: Voice-activated banking makes use of AI-driven speech recognition to enhance consumer interactions, permitting prospects to finish transactions or discover assist with out handbook enter. Name heart operations automated by speech recognition and chatbots can even enhance customer support and scale back idle occasions.

- Sentiment Evaluation: Sentiment evaluation—figuring out buyer sentiment or opinions from textual content knowledge—can be utilized to investigate buyer requires indicators of economic misery utilizing a wide range of pure language processing (NLP) instruments.

- Fraud Prevention and Threat Evaluation: AI fashions can detect surprising traits or outliers in monetary knowledge to forestall fraud, assess threat, and keep knowledge integrity. Picture recognition algorithms can even use visible knowledge like scanned checks and ID playing cards to extract necessary info to assist detect fraud, automate verification, and velocity up doc dealing with.

- Personalised Banking Providers: AI-powered suggestion methods present tailor-made monetary merchandise, corresponding to funding options and insurance coverage insurance policies, based mostly on consumer habits towards monetary industries’ web sites and social media in addition to their customers’ potential pursuits. Custom-made suggestions from these applied sciences improve buyer engagement and might drive income progress for monetary establishments.

- Automated Doc Processing: By automating doc extraction, doc classification, and such handbook and tedious duties as mortgage approvals, compliance checks, and contract administration, AI improves effectivity and lessens human errors.

- Buyer Service: Conversational chatbots can deal with buyer inquiries, resolve points, and supply tailor-made help across the clock to reinforce buyer satisfaction, decrease operational bills, and release time.

- Information Analytics: AI algorithms can analyze historic monetary knowledge to determine traits, forecast market actions, and optimize funding methods. Algorithms use refined strategies like regression evaluation to grasp the connection between monetary variables.

- Market Forecasting: Predictive fashions analyze historic knowledge to forecast inventory costs, market actions, and credit score defaults. These fashions enhance over time as extra knowledge is collected, benefiting buyers, monetary establishments, and companies by delivering higher projections and enhancing decision-making.

- Cybersecurity: AI detects and prevents cyberthreats to guard buyer knowledge by inspecting patterns for indicators of an assault. Automated response methods present for real-time risk mitigation by isolating impacted areas and neutralizing threats.

- Stress-Testing: Generative adversarial networks (GANs) and variational autoencoders (VAEs) can produce artificial knowledge that can be utilized to stress-test monetary fashions or simulate situations to assist establishments plan for various market circumstances and consider the effectiveness of their methods.

3 Challenges of AI in Finance

Whereas AI could allow monetary establishments to supply higher service and scale back handbook duties, there are nonetheless challenges to think about and handle, together with knowledge privateness, bias, and high quality issues.

Information Privateness and Regulatory Issues

Within the U.S., laws such because the Gramm-Leach-Bliley Act requires monetary organizations to guard customers’ private knowledge. Using AI, corresponding to chatbots, to entry private info raises knowledge privateness issues. To keep away from breaches, organizations should publicly declare their knowledge privateness insurance policies.

International regulatory organizations are addressing AI deployment in monetary companies to protect the system and stimulate innovation. The Bletchley Declaration, revealed by international locations in attendance on the international AI Security Summit in 2023, emphasised the worth of protected and accountable AI practices, for instance. A current U.S. Govt Order on AI outlines really helpful practices for dealing with AI-related cybersecurity issues, whereas the European Union’s AI Act categorizes AI know-how based mostly on threat and prioritizes client safety.

Learn our information to knowledge governance to study extra about compliance.

Bias in Algorithms

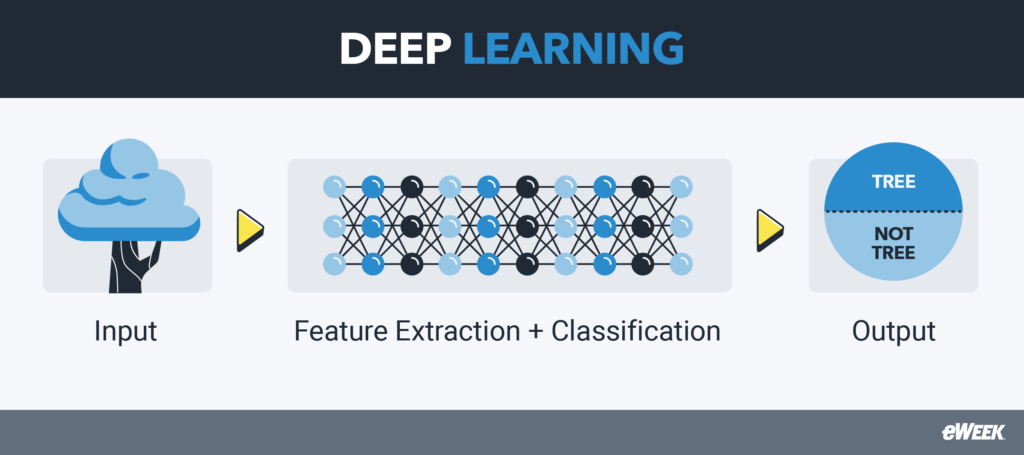

Presently, synthetic intelligence fashions should be educated on current datasets. Sadly, it’s frequent for AI fashions to bear coaching utilizing biased datasets that will underrepresent sure teams of individuals. This leads to AI instruments exhibiting bias too.

In finance, bias can lead to severe penalties for customers. For instance, credit score threat assessments accomplished utilizing a biased AI mannequin could preserve a person from securing a mortgage they’re certified for, merely based mostly on their demographics. For the shopper, this can be detrimental to their livelihood.

Information High quality Points

In line with many trade consultants, a key issue hindering the adoption of AI is knowledge complexity. Information is available in all styles and sizes and might be tough to handle. That is very true inside the finance trade. The complexities of knowledge can result in subpar high quality. Incorrect knowledge can result in fashions that make incorrect assumptions, leading to organizations making uninformed selections.

These selections can straight hurt the monetary well-being of their prospects. This subject is exacerbated by the shortage of knowledge science and AI professionals inside organizations. Many corporations are discovering {that a} lack of AI abilities, experience, and information is a hindrance to AI adoption.

3 Key Firms Utilizing AI in Finance

Using AI has drastically revolutionized the monetary enterprise, permitting monetary analysts to make better-educated selections and supply glorious service to their shoppers. Firms like Enova, Workiva, and Trumid have been on the forefront of this digital transformation, utilizing AI to optimize completely different elements of finance.

Enova

Enova Worldwide is a monetary companies firm that provides loans and funding to over 9 million prospects, together with small enterprises and people who find themselves uncared for by conventional banks. It employs cutting-edge web platforms, analytics, and machine studying algorithms to judge credit score threat, detect fraudulent exercise, and ship client insights. Enova’s data-driven techniques maximize credit score buying and selling by combining agile know-how with market understanding. The corporate’s AI-powered analytics allow it to study consumer preferences, personalize choices, and enhance consumer experiences.

Workiva

Workiva is a monetary know-how agency that aspires to create a future buying and selling community by combining agile know-how, trade expertise, and progressive product design by utilizing generative AI, which generates textual content and conducts analysis, for reporting and assurance to enhance productiveness and knowledge safety. Its know-how makes use of AI algorithms to automate monetary reporting operations, and pure language processing (NLP) enhances doc administration, compliance, and regulatory reporting by extracting insights from unstructured textual content knowledge. It additionally employs predictive analytics to anticipate monetary traits and enhance useful resource allocation.

Trumid

Trumid is a monetary know-how enterprise that makes a speciality of the company bond market. It supplies an digital buying and selling platform with 1000’s of bonds accessible for buy or sale, in addition to quite a few buying and selling protocols and execution options. Trumid makes use of AI algorithms for bond buying and selling and assessing market knowledge, liquidity, and historic traits to make offers at the very best pricing. It additionally employs market sentiment knowledge to information buying and selling strategies and optimize bond portfolios, balancing threat and reward relying on particular person preferences and market circumstances.

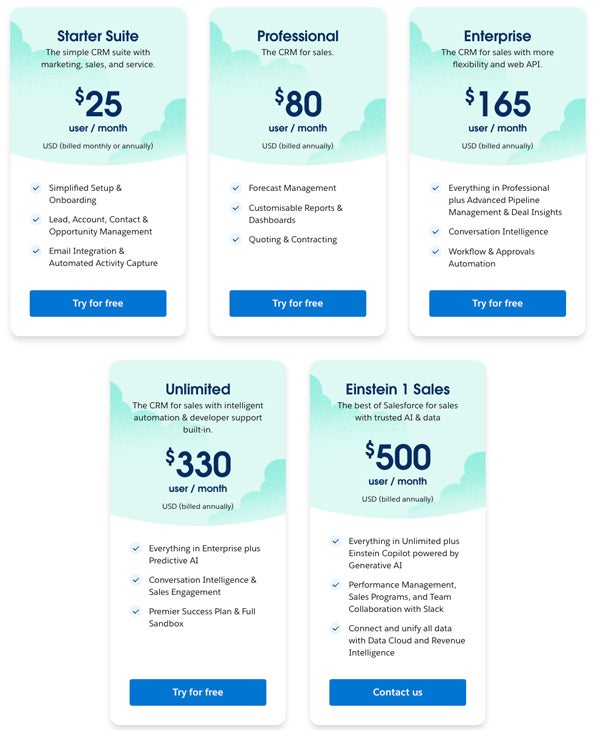

3 AI in Finance Programs to Take into account

The incorporation of AI into the banking trade is altering the way in which monetary analysis, buying and selling, and threat administration are completed. There are a number of intensive programs accessible to help professionals and hobbyists in understanding the sensible makes use of of synthetic intelligence in finance. These programs cowl a wide range of AI approaches and applied sciences particularly designed for monetary functions.

AI for Finance, Packt Publishing

Packt Publishing gives this AI for Finance course, which focuses on the sensible functions of AI within the monetary trade. It dives into quite a few AI approaches and applied sciences that will assist with monetary analysis, buying and selling methods, threat administration, and extra. It consists of an outline of AI’s affect on finance, machine studying approaches for monetary modeling, the usage of AI in algorithmic buying and selling, threat administration, fraud detection, and real-world examples. Meant for monetary consultants, knowledge scientists, and anyone eager about utilizing AI within the finance trade, it prices $10 on Udemy.

Go to Packt at Udemy

AI Purposes in Advertising and marketing and Finance, College of Pennsylvania

The College of Pennsylvania’s AI Purposes in Advertising and marketing and Finance course focuses on the mixing of AI, advertising, and finance, providing insights into how AI could affect decision-making and technique. The course covers AI-driven client habits evaluation, predictive analytics, and AI functions in monetary companies. It additionally discusses moral points in AI use. The audience consists of enterprise executives, entrepreneurs, monetary specialists, and college students who use AI of their jobs. This course is offered at Coursera and is included within the $59 month-to-month subscription price for Coursera.

Go to UPenn at Coursera

AI in Finance Specialization, CFTE

The Heart of Finance, Know-how, and Entrepreneurship (CFTE) gives an AI in Finance Specialization, which focuses on the usage of AI in numerous monetary industries. This system consists of AI applied sciences in banking, insurance coverage, and wealth administration, knowledge science for finance professionals, creating AI fashions for monetary functions, and regulatory and moral problems with AI in finance. The specialty is aimed toward finance professionals, fintech entrepreneurs, and anyone within the altering finance and know-how sector and prices $779.

Go to CFTE

Backside Line: The Way forward for AI in Finance

AI is prone to rework the monetary trade, with banking on the forefront. AI will enhance evaluation, integration, and enterprise transformation as finance groups collaborate throughout enterprises to change insights and generate worth. Generative AI will play an necessary function in company transformation by enhancing key processes and effectivity and offering individualized consumer engagement, tailor-made choices, and efficient knowledge exploitation.

AI-driven advances are predicted to save lots of banks as much as $487 billion by the tip of 2024, however moral points, regulatory hurdles, and accountable use will proceed to be issues because the trade faces the longer term.

Study extra concerning the step-by-step strategy of Learn how to Prepare an AI Mannequin to make correct and dependable monetary predictions.